MarginX Liquidity Pool APY/APR Comparison – Updated vs. Previous Rates

Following the 70% reduction in weekly reward emissions, we are providing a direct comparison of the new vs. previous APY/APR rates to highlight that the rewards remain significantly higher than before while ensuring long-term sustainability.

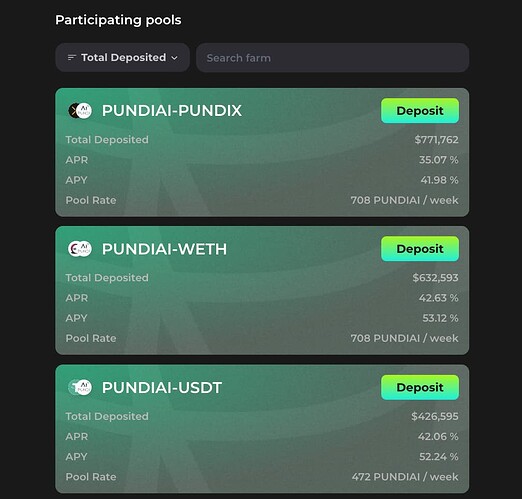

Updated APY/APR (Post-Adjustment)

PUNDIAI-USDT

- APR: 42.06%

- APY: 52.24%

PUNDIAI-WETH

- APR: 42.63%

- APY: 53.12%

PUNDIAI-PUNDIX

- APR: 35.07%

- APY: 41.98%

Previous APY/APR (Before Adjustment)

https://forum.pundi.ai/t/enhanced-incentives-for-liquidity-providers-on-marginx-liquidity-mining/6081

FX-USDT

- APR: 10.24%

- APY: 10.78%

FX-WETH

- APR: 15.35%

- APY: 16.59%

FX-PUNDIX

- APR: 26.13%

- APY: 29.85%

Key Takeaways – Rates Remain Higher Than Before

Higher APYs/APRs Across All Pools: Even after adjusting emissions, the current rates are significantly higher than the previous pools.

Sustainable Liquidity Incentives: This ensures that liquidity providers continue to receive strong rewards while protecting token value.

Deep Liquidity & Trading Activity: Encouraging healthy market participation and organic growth within the ecosystem.

Note: Rates are dynamically adjusted based on the total liquidity deposited in each pool. As more liquidity is added, APR/APY will adjust accordingly to ensure fair distribution of rewards.

With these updates, MarginX continues to prioritize both sustainability and competitive returns for liquidity providers.