AI Square Research Lab is an artificial intelligence firm specializing in the development of Industrial Solver Models—high-performance, domain-specific AI models designed to solve complex quantitative problems in high-volatility environments. Unlike large linguistic models, Industrial Solver Models are smaller, highly efficient AI systems optimized for specific industrial tasks where precision and adaptability are critical.

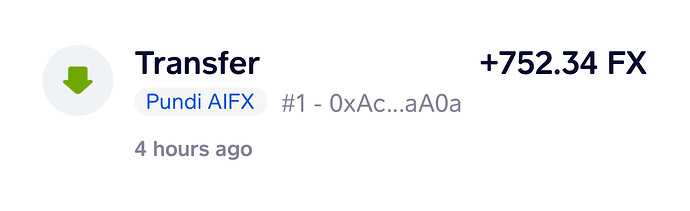

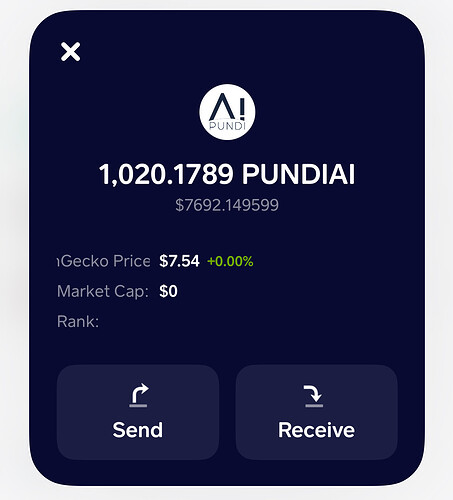

Our work has been recognized at the AI Pitchfest competition in December, where we were one of the winners. As part of this achievement, we are excited to collaborate with Pundi AI to explore how advanced AI-driven market intelligence can be applied in the Web3 ecosystem.

Introducing Our Project

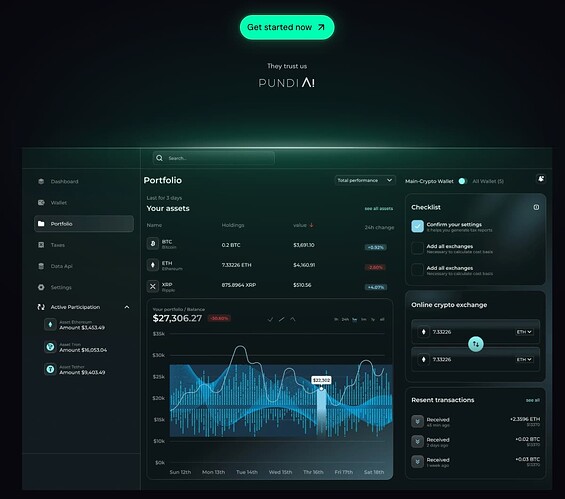

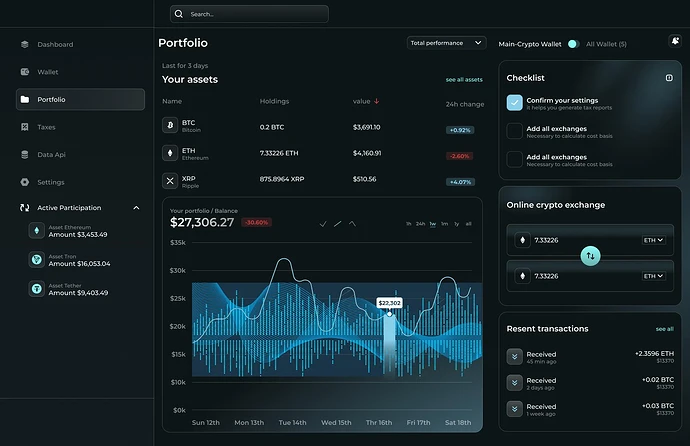

We are developing an AI-powered financial intelligence system that combines advanced signal processing, quantitative AI modeling, and decentralized finance. The core idea is to move beyond traditional blockchain analytics and create a predictive intelligence network that identifies market movements before they happen.

The Market Challenge

Cryptocurrency markets are driven by asymmetric information, irrational investor behavior, and the influence of institutional liquidity providers (whales). Existing blockchain intelligence platforms primarily focus on transaction monitoring but fail to predict market shifts before they occur.

Institutional traders use sophisticated quantitative models to anticipate liquidity movements, while retail traders often rely on lagging indicators, social sentiment, or speculative trading. This imbalance creates market inefficiencies and high volatility, leading to suboptimal trading decisions.

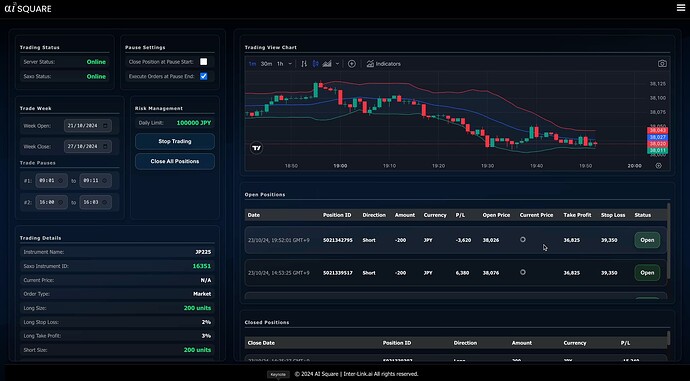

To address this challenge, we are building an AI-driven system that can extract meaningful predictive insights from blockchain transactions, market sentiment, and liquidity structures. Our approach combines:

- Time-Series Decomposition of Blockchain Transactions using Fourier and wavelet transformations to detect liquidity shifts.

- Liquidity Friction and Market Absorption Analysis to determine whether whale movements will trigger price changes.

- Behavioral Clustering and Market Regimes to classify whales into different trading strategies.

- Sentiment-Synchronized Market Responses using NLP models to analyze social media narratives.

This system is designed to provide actionable, real-time insights to traders, funds, and institutions, offering a competitive advantage in predicting liquidity-driven market movements.

Gamification and Value Proposition

To ensure long-term accuracy and engagement, we introduce a gamified AI validation system where users actively contribute to refining market predictions.

- AI Generates Probabilistic Market Predictions

- Example: “There is a 70% probability that Bitcoin will increase in price within the next 12 hours.”

- Users Validate or Challenge AI Predictions

- Users can stake tokens to either confirm or reject the AI’s forecast based on their own analysis.

- AI Learns from Consensus and Market Outcomes

- If the AI prediction is correct, those who agreed with it receive higher staking rewards.

- If the AI is incorrect and user consensus was right, the system weights those users more heavily in future predictions.

- Over time, the AI prioritizes the most consistently accurate traders’ inputs for model refinement.

- Building a Self-Learning Market Intelligence System

- This approach creates a continuous feedback loop where the AI adapts based on real market behavior and expert human input.

Economic Model of the Token

The token serves as the core utility mechanism of the ecosystem.

Token Utility

- Staking for AI Access

- Users must stake the token to access premium AI signals, real-time whale analytics, and high-confidence trade alerts.

- AI Prediction Market Participation

- Users stake tokens to participate in AI validation, competing for rewards and influencing model refinement.

- Transaction-Based Performance Fees

- A 2-5% fee is applied to successful AI-generated trades when users copy whale trading strategies.

- Institutional API Access

- Hedge funds, trading firms, and DAOs pay in token or stablecoins for API access to predictive market signals.

- Deflationary Mechanics

- A percentage of fees and incorrect AI votes are burned, reducing supply and increasing token value over time.

This economic structure ensures a balance between user incentives, AI development, and long-term token sustainability.

Engaging the Web3 Community

As a research-focused AI firm, our experience has primarily been in industries such as traditional quantitative finance and high-frequency trading. While we bring deep expertise in AI-driven market prediction, we are still new to Web3, and we recognize the importance of community involvement in shaping the future of this initiative.

Rather than developing this in a vacuum, we want to engage with the Web3 community early. We would love to hear your thoughts on this concept and, more specifically, your input on:

- Which cryptocurrencies should we prioritize in our first release?

- Which exchanges should we support to ensure maximum accessibility and adoption?

- What additional features would make this system most valuable to you as traders, developers, and investors?

We believe that the success of AI-powered market intelligence in Web3 depends on a collaborative approach, and we are eager to co-create this with the community. Your feedback will be invaluable in helping us refine our roadmap and ensure that we deliver the most impactful AI-driven solutions for decentralized finance.

Join the Discussion

We are excited to embark on this journey with Pundi AI and the broader Web3 community. Let us know your thoughts, suggestions, and any questions you may have. Together, we can shape the future of AI-powered market intelligence in the decentralized economy.