Key Points

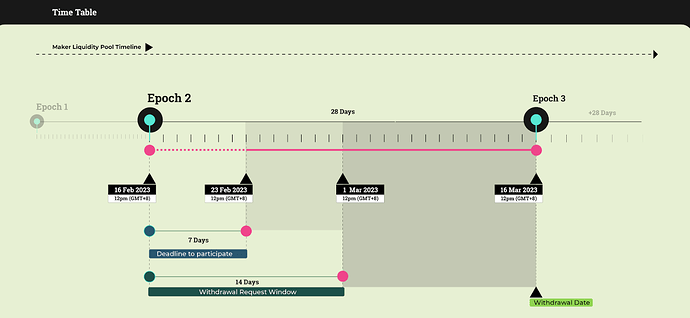

- The MarginX AI Bots Trading Pool will be implemented at the start of Epoch 2 from 16 February 2023 12pm (GMT+8).

- Blockchain: Ethereum ($ETH needed for gas fees)

- Accepted token: USDT (ERC-20)

- Deadline to deposit funds: 23 February 2023 12pm (GMT+8)

- Fund lock-up period: Until 16 March 2023 12pm (GMT+8)

- Deadline to make withdrawal request: 1 March 2023 12pm (GMT+8)

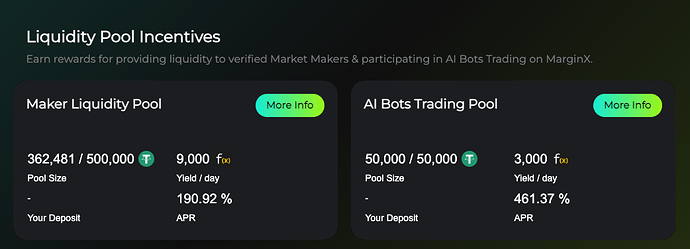

- Maximum pool cap: 50,000 USDT

- There are no principal guarantees.

note: Maker liquidity pool will be cap at 500,000 USDT on epoch 2.

Overview

Since the launch of MarginX’s very first Maker Liquidity Pool (Beta), over 368,000 USDT has been deposited by over 50 participants. More than 3 million transactions have been made, generating over 4.5 million USDT of trading volume and contributing to a profit of 1,500+ USDT in Epoch 1. This means that the APY for Epoch 1 was 8+%.

The beta version of the Maker LP has received overwhelming interest from our community as this mechanism not only further enhances market depth, but also lowers the entry barrier for participants and makes trading easier for everyone.

As I had discussed in my last post, the Maker LP was our first attempt (or, rather, an experiment) at creating an automated trading and fund management structure, where participants deposit their money into different ‘funds’ with distinct strategies, capital requirements, risk appetites and durations, and thereafter share the risks and rewards effortlessly (i.e. without having to trade themselves).

With this in mind, MarginX remains committed to the vision of becoming the key infrastructure for DEX trading.

MarginX AI Bots Trading Pool (Beta Version)

Adding another option to the Maker LP, MarginX will roll out a new AI Bots Trading Pool (beta version). Participants can choose to let the fund managers (i.e.a series of artificial intelligence trading algorithms) deploy and run trading strategies on their behalf. To be more specific, AI bots trading uses machine learning frameworks to analyze millions of data points and execute trades at the optimal price with specific strategy. AI trading bots also analyze forecast markets with greater accuracy and trade firms efficiently which mitigate risks and provide higher returns

The trading pool shall be managed and operated independently by AI. Participants of the trading pool shall bear the risks and rewards proportionate to the performance of the pool. For example, if Alice deposits $200 in the pool, the asset under management (AUM) of the pool is $1,000, and the pool makes a profit of $100 at the end of the settlement period, Alice shall be entitled to an $18 profit (200 / 1,000 * 100) * (1 - 10% profit sharing ratio).

Some points to note:

- No minimum capital requirement - participants can deposit funds from as little as 1 USDT

- Maximum pool cap: 50,000 USDT

- Deadline to deposit funds: 23 February 2023 12pm (GMT+8). The pool will be closed earlier if it reaches the maximum cap.

- Fund lock-up period: Until 16 March 2023 12pm (GMT+8).

- At the end of Epoch 2, participants will only be allowed to withdraw their funds if they had made a withdrawal request before 1 March 2023 12pm (GMT+8).

- Insurance pool (maximum liability of fund manager): 10,000 $FX (provided by the fund manager)

- Insurance threshold: 15%

- Management fees: 0%

- Performance fees: 10% (excluding $FX reward). The fund manager will get a 10% profit share. For example, if the pool makes a $1,000 profit at the end of the day, the fund manager is entitled to a $100 performance bonus (10% * 1,000).

- Participants can claim their $FX rewards any time.

- Profit and Loss calculation: Closing balance - Initial balance = Profit / Loss

IMPORTANT DISCLAIMER:

THIS IS THE BETA VERSION. YOU MIGHT LOSE YOUR PRINCIPAL. PARTICIPATE AT YOUR OWN COST.

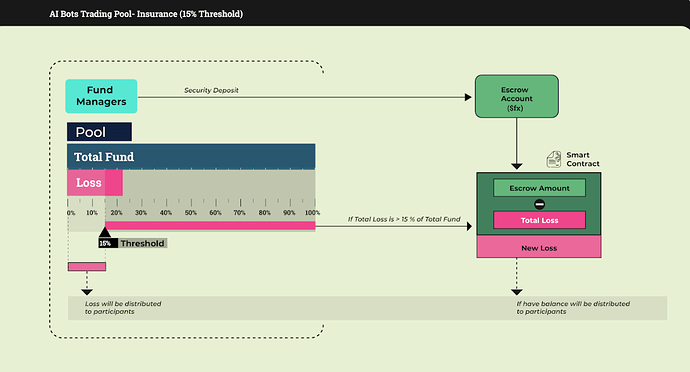

Insurance Pool

Despite the fact that the fund of the pool can only deploy on MarginX (they cannot execute a rug pull), an insurance mechanic has to be put in place, since these fund managers have full control over participants’ funds right after they have made their deposits. To balance and protect the participants’ interests, an insurance pool shall be implemented.

An insurance pool is a sum of money provided by the fund manager into an escrow account, which acts as a safety net or insurance fund for participants. If the loss of the pool exceeds the insurance threshold (15%), the smart contract will compensate the affected participants by deducting from the insurance pool. However, in any event, the fund manager shall not be liable for any more compensation than the total amount of the insurance pool, even if the loss is greater than the insurance pool. In future, MarginX looks to implement a mandatory stop loss feature when the loss exceeds the insurance pool.

Let’s dive into some examples.

Example 1:

Assume the total AUM is $10,000, and the loss is $2,000 (20%>15%). The loss triggers the 15% threshold. Assume 1 $FX is $0.20, and the escrow account has a total of 10,000 $FX. The loss that shall be borne by the fund manager is (2,000 - 1,500) $500. Hence, 2,500 $FX will be deducted from the escrow account to compensate participants, and all participants suffer a loss of $1,500.

Example 2:

Assume the total AUM is $10,000, and the loss is $1,000 (10%<15%). The loss does not trigger the 15% threshold. No $FX will be deducted and participants will suffer the loss of $1,000.

Example 3:

Assume the total AUM is $10,000, and the loss is $4,000 (40%>15%). The loss triggers the 15% threshold. Assume 1 $FX is $0.20, and the escrow account has a total of 10,000 $FX. The loss that shall be borne by the fund manager is (4,000 - 1,500) $2,500. Hence, all 10,000 $FX will be deducted from the escrow account to compensate participants. However, participants still suffer a $2,000 loss.

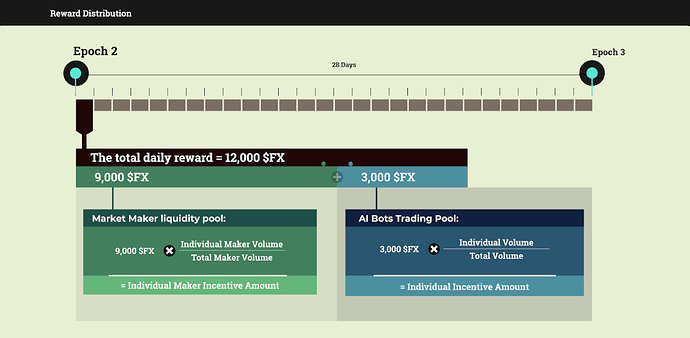

New $FX Reward Distribution

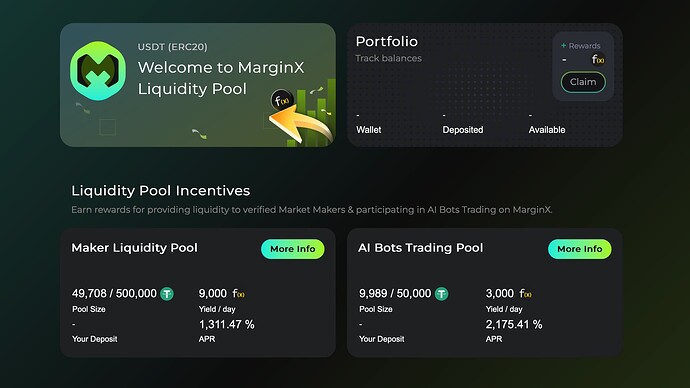

To encourage participation of both Maker LP and AI Bots Trading Pool, the team has reallocated the $FX rewards of the MarginX 100-Day Incentive Program. The total rewards for Epoch 2 remains at 12,000 $FX / day, and can be divided into the following:

Maker Liquidity pool: 9,000 $FX / day

AI Bots Trading pool: 3,000 $FX / day

Conclusion

Differences between Maker LP and AI Bots Trading Pool:

| Maker LP | AI Bots Trading LP | |

|---|---|---|

| Trading period | All time | Only when there is a trading opportunity |

| Focus | Providing liquidity | Profit seeking |

| Trading pattern | Passive | Active |

Participants can deposit their USDT into any pool they choose. Please take note that the pools and deposits are not principal protected.

Transparency, security and convenience always come at a cost. At MarginX, we thrive to lower the entry barrier for mass adoption.

Lastly, please always DYOR and participate only if you fully understand the risks.

Note: MarginX welcomes interested traders and developers to build their algorithms upon MarginX’s framework.