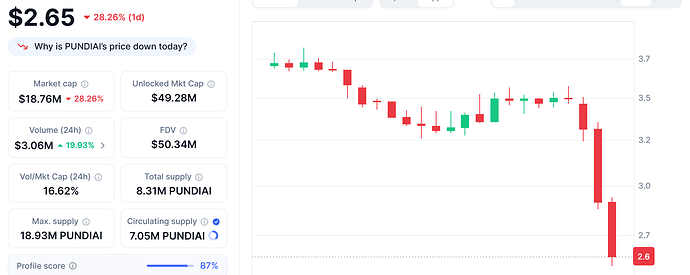

anyone have ideas what caused the drop today?

28 August upbit and bithumb will delisting pundi ai

Panic seller

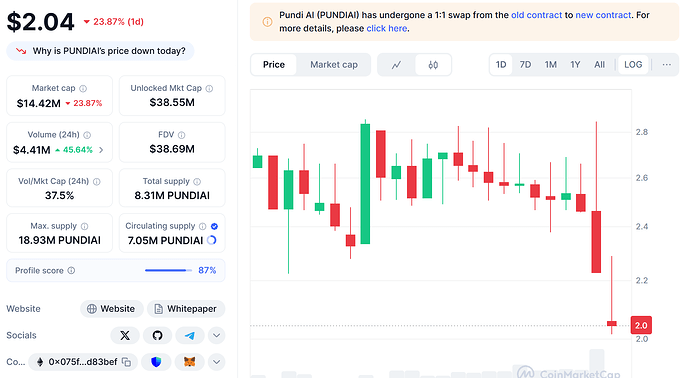

doesnt look any better today blew through the small resistance it had at 2.2. will it drop below $2?

where will it find support?

Hi @orbitant !

Any info regarding why liquidities are that low (never been so low since the launch ~130k$) over MarginX DEX ? (note : this started long before the hack)

Regards

@FrenchXCore

Hi @FrenchXCore

Possible scenarios we think may explain the drop:

-

Liquidity on MarginX is supplied entirely by token holders, so the DEX cannot control the volume

-

Market conditions and price action may have reduced on-chain activity

-

LPs could be rotating to pools with higher APR or short-term incentives

-

Focus on the Data Pump launch on BNB Chain and talk of a move to Ethereum may have shifted attention and funds

-

Security concerns after the exploit, even if the decline started earlier, may keep some providers cautious

MarginX is reviewing several business options in line with decisions being made for the Pundi ecosystem. As the discussion is still ongoing, we have no further comment for now.

Cheers!

Are any ongoing discussions regarding FX issue here now?

no different subject, resolutions are still pending.

liquidity of pundiai affects token economics of any proposed swap

Correct the failure of FX holders to swap, are cause and affect of the market value disparity of both markets, failure of FX holders to move into the new Project are in affect the cause of our whole situation. the old coin was always going to zero because after a time it becomes un-supported 99% swapped out, People only stayed in FX to exploit the market in difference because they knew there would be one. PUNDIAI will continue as it has open markets and it’s " The fully supported project ", it will recover especially if the FX is not recovered as the PUNDIAI supply would be reduced I believe that result can only benefit PUNDIAI holders. Note the hacker have no market power or liquidity on the PUNDIAI Market; in any case FX is always going to zero & was since the swap was initiated. and it’s not a proposed swap; it’s an active well known project action-ed upgrade that should of be done in quick time, the failure was in the projects kind nature to give holders extra time to get the job done; has only lead to US the true project supporters being compromised. because if your not in PUNDIAI before now your not a project supporter. your purely a trader & liability to PUNDIAI.

The transfer function on FX was paused to prevent hackers to do transactions with the token, which unfortunately affect all FX transactions (except swap to PUNDIAI).

PUNDIAI supporter should also hold something in mind, Converted to PUNDIAI in my calculations of coinbase holdings on ether scan, there would be only 0.2% of the supply in concern relation to the coinbase debarkle token, It’s nothing of significance to affect the PUNDIAI project future’s. unlucky for those in FX I do feel for you, but you won’t be the end of PUNDIAI.

currently Coinbase is still actively discussing for support - last words I had with the project today

Can u please elaborate this statement?

The FX to PUNDIAI swap has a fixed rate, there is no connection with liquidity of PUNDIAI.

Price stability and slippage are determined by liquidity depth. If liquidity is thin, swaps can be manipulated, producing artificial volatility and enabling pump-and-dump schemes.

swap quantity is a fixed rate 100 to 1 “quantity” Value or Liquidity has nothing to do with it, you have 100 you get 1, if you wanted to have no value change you should have swapped when the swap started. It’s as simple as that, snooze you loose.

the only reason the swap was not over a 3 month period was designed for the slow few to get the job done if their slow to see the projects upgrades & new direction; the long allowance to swap was not left there for people to take advantage of the market, which was an advantage for months, FX was always swapping out that game was always coming to end, the hacker ended it.

I don’t know why you keep saying that — tokenomics are more than just a swap ratio. Without liquidity, the swap won’t even execute in the pools. Tokenomics aren’t about parroting some magic number. You can repeat it like it’s the Ten Commandments, but without liquidity it’s worthless. On AMMs like Uniswap, swaps don’t care about your formula — they care about liquidity depth and market dynamics. No liquidity, no swap. Your ratio is just a fairy tale you keep telling yourself.

when the token is swapped it’s got Liquidity from your own wallet hold, you have 100 it becomes 1, your wallet supplies the Liquidity, Don’t know what your trying to build on here.

the only thing I can think of is - your talking about Trade swap, which is nothing to do with the network Token 100 to 1 contract swap - that’s not even in the same subject category

^ have nothing to do with the token swap, it’s a pure on chain exchange with the project contract, not a dex or exchange trade swap.

like the 10 Commandments a network token contracted swap is written in stone, and is a set in stone configuration unchanged by worldly forces, except when a hacker finds a backdoor. the contract is a one on one direct conversation between one networks token to change it directly to the new. if the swap is done on eth network the fee is in eth, there is not even a fee on the token being swapped it self.

At the moment it would cost the exchange 10 mins & about 50c in eth to swap all the members coin; all in one go and hand you back a viable project token and you would only be waiting for market recovery. if it’s done any different I don’t think you’ll get any value back at all; you will not beat the hacker to the market. put that in perspective

Can I ask where we are now in solving the issue?

the response is the same, they are in continuing conversations with the Exchange, when there’s new news it will probably be on the original discussion not this one - the subject has to do with market here.

I’m lost already in all these threads. Is the any bug reported where we can track the progress?

Its up so much today but too bad can’t touch that funds. Heartbroken

need to under stand there is only a small portion of the market cap in FX, like less than 0.2% in PUNDIAI worth as un-swapped coin in FX, that small amount will be creating a false value.

In the resolve of this situation I doubt you will end up with FX, I don’t believe it’s going to be possible.

but in any case if you do end up with FX any sale of FX will most probably have a very dramatic affect on the value to the point maybe only a few of you would get out with any gain of any rise in market, your deluding yourself worrying about the FX market it’s not a true reflection of the reality of it’s value.

in the NPXS swap to PUNDIX many lived on the delusion it was better to stay in the closing market of NPXS and got suck there because the swap contracts finished - closed, yes they have an end date. so they lost all value they had in NPXS because they fail to understand the project up-graded to a new token and the old has an end date of support believing the shrinking MC & supply of the old coin was a bonus they could leverage to the death and didn’t understand when to let go.

this is not an opening to complain about the old swap I will delete anyone who dose.

Fx Coinbase situation has been resolved, please reference the main post about that topic.