ALO!

Following the approval of Proposal #62 for 20 million $FX (2024), we are excited to announce the balance for deployment of 19 million $FX in liquidity rewards to support the upcoming token redenomination from $FX to $PUNDIAI. This strategic initiative is designed to enhance liquidity, stimulate trading activity, and drive the adoption of $PUNDIAI within MarginX.

View Proposal #62: PundiScan

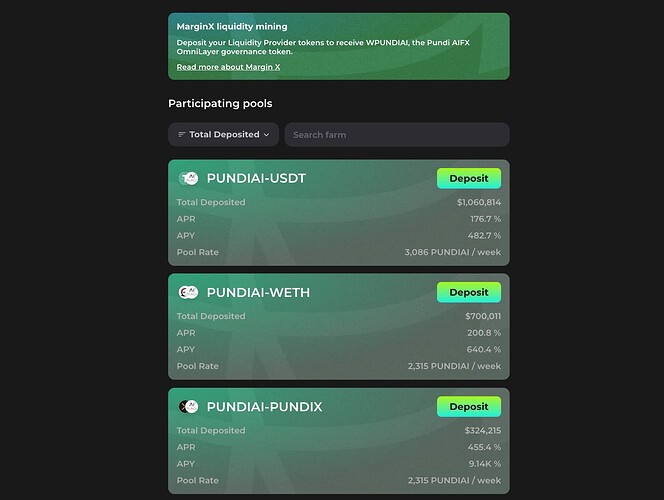

MarginX - Liquidity Mining Pool

https://swap.marginx.io/#/farm

2025 1st Round Deployment: 50% Allocation

In the first round, we will deploy 50% of the total rewards, amounting to 9.5 million $FX, across the following liquidity pools:

- FX-USDT: 40% of the total rewards

- FX-PUNDIX: 30% of the total rewards

- FX-WETH: 30% of the total rewards

This distribution strategy aligns with past trading volumes and aims to maximize liquidity and user engagement.

Estimated Rewards Breakdown

Total Reward Pool: 9.5 Million $FX

Distribution Duration: 3 Months

- FX-USDT: 3.8 Million $FX (40%)

- FX-PUNDIX: 2.85 Million $FX (30%)

- FX-WETH: 2.85 Million $FX (30%)

Estimated Monthly Distribution

To distribute the rewards within 3 months, the monthly allocation will be as follows:

Total Monthly Distribution: ~3.17 Million $FX

- FX-USDT: ~1,266,667 $FX

- FX-PUNDIX: ~950,000 $FX

- FX-WETH: ~950,000 $FX

Estimated APR/APY Calculation

Using past records as a reference and comparing them with the new proposed rewards, we estimate the following ranges:

FX-USDT

Previous APR: 10.24% | Proposed APR: ~48% to ~75%

Previous APY: 10.78% | Proposed APY: ~61% to ~94%

FX-PUNDIX

Previous APR: 26.13% | Proposed APR: ~112% to ~160%

Previous APY: 29.85% | Proposed APY: ~146% to ~208%

FX-WETH

Previous APR: 15.35% | Proposed APR: ~58% to ~90%

Previous APY: 16.59% | Proposed APY: ~76% to ~118%

Average Previous APR: ~23% | Average Proposed APR: ~69% to ~103%

Average Previous APY: ~27% | Average Proposed APY: ~84% to ~129%

These ranges highlight the potential for attractive returns, depending on trading volume and liquidity conditions.

Note on Estimated APR/APY Calculation

The estimated APR/APY figures provided above are hypothetical and based on historical data. Actual APR/APY will be calculated based on the real-time pool size and trading volume once the rewards are deployed. These numbers are intended to provide an illustrative example of the potential returns and may vary depending on market conditions.

Token Redenomination Details:

- Redenomination Date: 25 February 2025

- Commencement of Rewards Deployment: 1 March 2025

- Conversion Rate: 100:1 (100 $FX = 1 $PUNDIAI)

- Current $FX Price: $0.1637 (as of 25 February 2025)

On the redenomination date, all pools within MarginX will be automatically converted from $FX to $PUNDIAI based on the conversion rate of 100:1. This seamless transition ensures that all liquidity providers and traders benefit from the new tokenomics while maintaining their proportional holdings.

Why This Matters

-

Support for Token Redenomination: The deployment supports the transition to $PUNDIAI, ensuring continued liquidity and trading activity during the redenomination process.

-

Boosted Rewards: With 50% of the total rewards being deployed in the first round, liquidity providers will benefit from enhanced APR/APY rates, maximizing returns.

-

Strategic Growth: This initiative strengthens the MarginX ecosystem, driving adoption and engagement with the newly denominated $PUNDIAI token.

Next Steps:

-

Rewards Deployment: The 1st round of rewards will commence on 1 March 2025 across the three liquidity pools listed above.

-

Automatic Conversion: All pools in MarginX will be automatically converted to $PUNDIAI on 25 February 2025 at the conversion rate of 100:1.

-

Future Updates: The remaining 9.5 million $FX will be deployed in subsequent rounds. Stay tuned for more updates on timing and distribution strategies.

Thank You for Your Continued Support!

This strategic rewards deployment is part of our ongoing commitment to enhancing liquidity, rewarding our community, and driving the growth of the PUNDI AI ecosystem. We appreciate your support and participation in this exciting transition to $PUNDIAI.

Let’s continue to grow together!

The MarginX Team

Reference Posts:

Enhanced Incentives for Liquidity Providers on MarginX Liquidity Mining

https://forum.pundi.ai/t/enhanced-incentives-for-liquidity-providers-on-marginx-liquidity-mining/6081

MarginX - Liquidity Mining Pool

https://swap.marginx.io/#/farm