ALO, Farmers & Swimmers!

The network adjustments have been completed, and the APR/APY percentages are now displaying correctly. Everything has returned to normal, ensuring smooth trading and liquidity mining on MarginX.

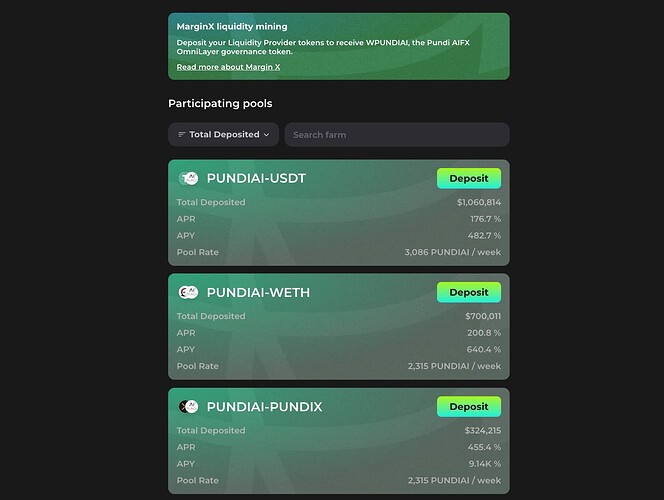

MarginX - Liquidity Mining Pool

[QUICK RECAP]

2025 1st Round Deployment: 50% Allocation

In the first round, we deployed 50% of the total rewards, amounting to 9.5 million $FX (95,000 $PUNDIAI), across the following liquidity pools:

- PUNDIAI-USDT (FX-USDT): 40% of the total rewards

- PUNDIAI-PUNDIX (FX-PUNDIX): 30% of the total rewards

- PUNDIAI-WETH (FX-WETH): 30% of the total rewards

This distribution strategy aligns with past trading volumes and aims to maximize liquidity and user engagement.

Estimated Rewards Breakdown

Total Reward Pool: 9.5 Million $FX (95,000 $PUNDIAI)

Distribution Duration: 3 Months

- PUNDIAI-USDT (FX-USDT): 3.8 Million $FX (38,000 $PUNDIAI) (40%)

- PUNDIAI-PUNDIX (FX-PUNDIX): 2.85 Million $FX (28,500 $PUNDIAI) (30%)

- PUNDIAI-WETH (FX-WETH): 2.85 Million $FX (28,500 $PUNDIAI) (30%)

Actual APR/APY Post Deployment – Significantly Higher than Expected

PUNDIAI-USDT (FX-USDT)

- Actual APR: ~175.9% [Proposed APR: ~48% to ~75%]

- Actual APY: ~478.4% [Proposed APY: ~61% to ~94%]

PUNDIAI-PUNDIX (FX-PUNDIX)

- Actual APR: ~432.2% [Proposed APR: ~112% to ~160%]

- Actual APY: ~7230.5% [Proposed APY: ~146% to ~208%]

PUNDIAI-WETH (FX-WETH)

- Actual APR: ~199.5% [Proposed APR: ~58% to ~90%]

- Actual APY: ~631.2% [Proposed APY: ~76% to ~118%]

Overall Comparison:

Actual APR: ~175.9% to ~432.2% [Estimated APR: ~69% to ~103%]

Actual APY: ~478.4% to ~7230.5% [Estimated APY: ~84% to ~129%]

Read Before Participating

Important Considerations Before Participating in MarginX Liquidity Pools & Farming

If you are unfamiliar with these risks, do not participate without conducting thorough research or consulting with experienced community members. MarginX is designed for users with a strong understanding of DeFi protocols and associated risks.

Reference Posts: