Preface

As mentioned in the previous RFC article, Pundi X rewards is being reviewed to facilitate, enhance and accelerate the growth of the Pundi X network and to function as the block reward token of the upcoming Pundi X Chain powered by Function X. We believe this will tremendously benefit $PUNDIX and $NPXSXEM token holders.

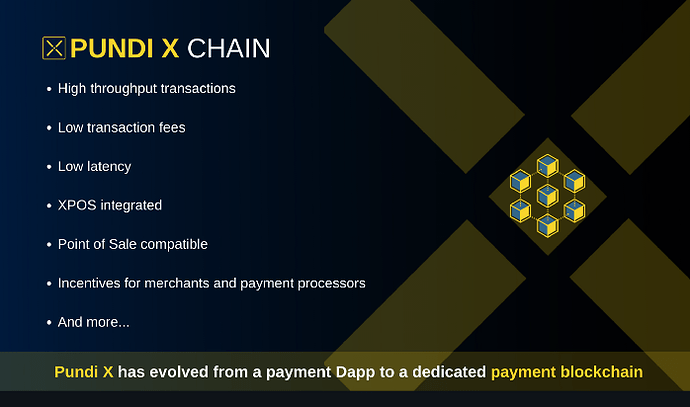

Pundi X Chain

Pundi X Chain is a dedicated payment-focused blockchain in the Function X network. It is specially designed to perform high throughput transactions with low latency and low transaction fees. In addition, it provides room for future compliance requirement upgrades, hardware (XPOS) integration and Point-of-Sales compatibility, with a tokenonomy offering incentives to merchants and payment processors.

Due to the rapid change of market conditions, recent technological advancements and the development of Function X, the team has been looking for a solution to bring crypto payments to the next level. After numerous trials and significant effort, Pundi X can now embrace the decentralized network by running payment services on its own blockchain to further promote the vision of making ‘buying/selling/spending crypto as easy as buying a bottle of water’ in a decentralized network.

It is an upgrade and further actualization of our vision.

Pundi X has evolved from a payment Dapp to a dedicated payment blockchain.

Pundi X Chain structure

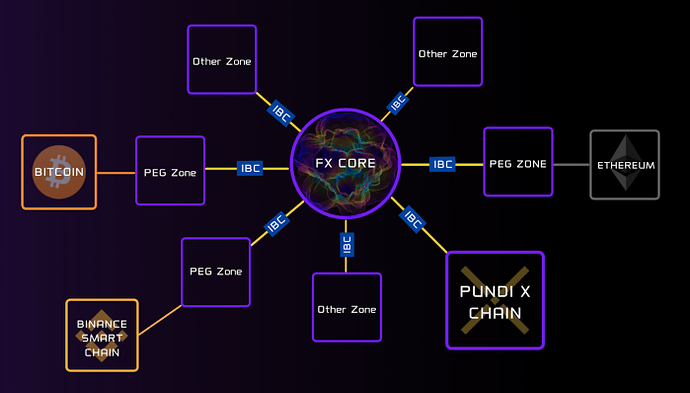

The multi-chain structure of the Function X network enables others to set up and customize their own blockchain network on FX Core. To provide a simple analogy, Function X network is like a piece of land that is fully equipped with foundation, concrete and pillars in the form of (f(x) Cloud, f(x)Wallet, etc. Developers or projects can build their highway effortlessly on the existing foundation of Function X’s land. The initial purpose, languages and currency charges of each highway might vary, one from another, so we need a coordinator and connecting point to be able to communicate. FX Core is the main interchange bridge that connects to all the different highways.

Pundi X Chain is one of the many highways / branches that are built on the land (Function X). It is connected to FX Core to be able to communicate with external networks (such as Ethereum and Binance Smart Chain) and internal blockchains.

Mechanic of Pundi X Chain

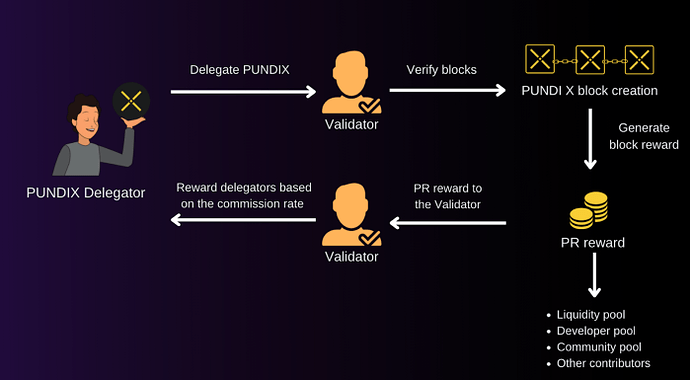

Pundi X chain inherited the infrastructure setting and consensus model of the Function X network. Similar to Function X , Users can delegate their $PUNDIX token into the validator node to participate in block validation and in return delegators and validators will receive block rewards for their contribution and effort.

Block rewards tokens are created every block and distributed among validators, delegators, the liquidity pool, developer pool, community pool and other contributors participating in the consensus process and ecosystem enhancement. This provides an incentive to $PUNDIX holders to not just passively hold their tokens in wallets, but to put them to use in order to secure the network, liquidity enhancement and enrich the ecosystem.

Instead of a fixed rate, the number of new block rewards tokens created per block varies and depends on the percentage of the total token supply that is staked in the network.

The generation of new block rewards tokens is a dynamic process and it is subject to the staking ratio in the blockchain. In theory, it keeps changing until it reaches the maximum or minimum inflation rate. For example, if there are 100 million $PUNDIX tokens staked in the network (total supply of $PUNDIX is 258 million), the staking ratio is around 38.76% (100m /258m). If the current staking ratio > target staking ratio, the inflation rate per block is decreasing; if the current staking ratio < target staking ratio, the inflation rate per block is increasing; if the current staking ratio = target staking ratio, the inflation rate per block remained the same (as the previous block).

It is worth noting that, one of the key differences between $FX block validation and $PUNDIX block validation is the block reward token being created. In Function X, the delegating tokens and block rewards tokens are the same, however, in the Pundi X chain, the delegating tokens and block rewards tokens are different.

Formula and calculation

The main structure of PUNDIX Chain is derived from FX Core, hence the underlying block reward calculation is similar to what’s been created for FX Core.

The calculation of the new block rewards tokens can be divided into 2 parts:

Part 1: New token creation per block and Inflation rate

Inflation rate per block = (1 — Current staked ratio / targeted staked ratio) * inflation_rate_change_variable / annual number of block creations

Number of new token creation = ( Previous annualized block inflation + inflation rate per block) / annual total block creation * current token supply

Part 2: Distribution to validator and delegate Reward rate formula for validator =

[(Total current token supply * inflation rate * current staked ratio * block) * (1 — community & ecosystem tax rate)] * [(total self delegated token / total staked token of the node * (1 — commission rate) * participation period + commission earning]

Reward rate formula for delegator =

[(Total current token supply * inflation rate * current staked ratio * block) * (1 — community & ecosystem tax rate)] * [(total delegated token / total staked token of the node * (1 — commission rate) * participation period]

Users can refer to the calculator below:

https://pundix.com/delegation-reward

Pundi X rewards token (provisionally ‘$PR’ token) as block reward

$PUNDIX token is a deflationary token. It is fully unlocked and reached the maximum token supply in 2019. According to the whitepaper, NO new $PUNDIX token can/will be created to dilute the interest of current token holders.

Therefore, to further stimulate the growth of the network, incentivize stakeholders and encourage use of the upcoming Pundi X Chain without jeopardizing the interest of $PUNDIX, we are proposing to introduce a new Pundi X Rewards token (provisionally called ‘$PR’) to facilitate the growth.

As mentioned in the previous article, the new $PR token is a secondary token with limited access and utility in the Pundi X network. $PUNDIX is the primary token to govern the whole network. Other than the initial supply of $PR tokens, the only way to generate new $PR tokens is through block validation in the Pundi X Chain.

The initial supply is 64 billion $PR tokens. There is no maximum supply. The initial supply will be distributed to $PUNDIX holders and through a 1:1 conversion for $NPXSXEM holders. The $PR token is not meant for speculation but acts as a loyalty token, therefore a token lockup mechanism and BDL (burn, distribute and liquidity) mechanism are imposed.

Further proposed details of $PR token can be found here: https://medium.com/pundix/request-for-comment-pundi-x-reward-token-project-name-pr-ef61dc98f1f2

Proposed parameter of block rewards

There is one important concept before we dive in:

Delegating $PUNDIX to get $PR in Pundi X Chain

The reward rate and inflation rate shown below shall NOT affect or increase the token supply of $PUNDIX. The supply of $PUNDIX is fixed and can only be decreased.

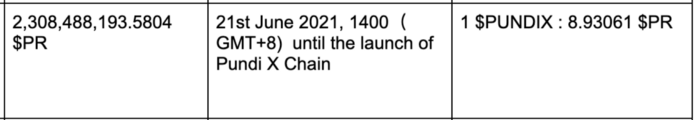

Considering that the token supply of $PUNDIX is 258,491,637 and the initial supply of $PR is 64 billion, the team is proposing the following:

Initial annual inflation rate: 3000%

Maximum annual inflation rate: 4000%, minimum annual inflation rate: 2000%

Ecosystem, liquidity and community pool : 25% (shared by the liquidity rewards, XPOS merchants, transaction mining and developers)

Target staked ratio: 51%

Inflation rate change variable: 100%

Commission rate of validator node: 3%

According to the proposed parameters, if the market staking ratio is 20%, the block reward is estimated to be 89,691 $PR tokens for every 10,000 $PUNDIX tokens delegated for 30 days. (for reference only)

All parameters are adjustable through $PUNDIX governance on-chain voting.

Initial distribution of Pundi X rewards tokens (‘$PR token’)

For $PUNDIX holders — holding in private wallet to claim

We will take daily snapshots of the average $PUNDIX held in individuals’ ERC-20 wallets during the calculation period.

Distribution formula:

Average daily holding of $PUNDIX during the calculation period per wallet address * total claimable $PR tokens during the period.

For example, Alice holds 10,000 $PUNDIX in her wallet from 1st September until 15th September, and holds 20,000 $PUNDIX from 16th September until 30th September, and Pundi X Chain launches on 1st October. Thereafter the total claimable $PR tokens for Alice is 133,959 $PR. [(10,000 15) +(20,00015)] /30 * 8.93061]

The claiming schedule is set out below:

$PR token will be running on Binance Smart Chain (BEP20) , hence users have to claim it manually. No claim, no token. All unclaimed $PR tokens will be forfeited.

For $NPXSXEM holders — conversion and migration

There is a 90-day migration window. The migration ratio is 1:1. Users have to send their $NPXSXEM to a designated smart contract to convert to $PR tokens. There is a 12-month lockup period for the initial distribution of the $PR tokens. $NPXSXEM migration users will get 12% of the total claimable tokens right after the migration, and the remaining 88% will be unlocked (8% every 30 days) over the next 11 months.

For example, if Alice sends her 100,000 $NPXSXEM to the designated bridge and migrates to 100,000 $PR, she will get 12,000 $PR right after the migration and receive another 8,000 $PR every 30 days thereafter until she receives a total of 100,000 $PR.

Please join the discussion and share your thoughts with us at http://forum.pundi.ai/ and https://www.reddit.com/r/PundiX/

Lastly, please always do your own research (DYOR). Rewards are not possible with risks. The crypto space is full of uncertainty. No one can guarantee your success.